Small business insurance software makes it easier to manage quotes, policies, and renewals—all in one place. Instead of dealing with scattered documents or endless broker calls, business owners can compare coverage, track policies, and stay on top of deadlines through a single dashboard.

It saves time, reduces manual work, and helps ensure you’re always covered. For businesses that want to stay organized and compliant without extra hassle, this software is a smart solution.

What This Blog Includes

This guide walks you through the essentials of choosing small business insurance software, including:

- What it is and how it works

- Who it’s best suited for

- Key features to look for

- Top software platforms with pricing

- Tips to get started quickly

Perfect for small business owners looking to save time, reduce risk, and find the right coverage in one place.

Who Needs This Software?

Small business insurance software is a practical solution for anyone responsible for managing insurance tasks within a growing company. It helps reduce the guesswork, keeps everything organized, and saves hours of admin time. Here’s a closer look at who benefits most:

🧑💼 Small Business Owners

Compare quotes, manage coverage, and get renewal alerts—all in one place, no broker calls needed.

🤝 Independent Brokers

Handle quotes, documents, and policies faster to give clients a smooth, professional experience.

🧑💻 HR & Office Managers

Update employee info, manage workers’ comp, and track leave coverage with less hassle.

📊 Bookkeepers & Accountants

Access insurance docs, monitor liability, and stay audit-ready with a clear, organized system.

Small Business Owners

If you’re wearing multiple hats—handling operations, finances, and HR—this software helps you stay in control of your coverage. You can easily compare quotes, store policies, and receive alerts before renewals are due. No need to dig through emails or call your broker every time something changes.

Independent Insurance Brokers

For brokers who work with small and midsize clients, this tool simplifies the way you manage client accounts. It supports quote generation, document sharing, and policy tracking—all in one system. It helps you move faster and deliver a more professional experience to your clients.

HR or Office Managers

When you’re juggling onboarding, payroll, and benefits, insurance can become one more task in a long list. With this software, you can easily handle workers’ comp, update employee data, and track leave-related coverage—without switching between systems or dealing with paper files.

Bookkeepers and Accountants

If part of your role includes managing compliance or preparing for audits, this software gives you the visibility you need. You can quickly find documents, track liability coverage, and ensure the business stays up to date with local requirements.

Key Features to Look For

| Feature | What It Helps With |

|---|---|

| Quote Comparison | Review plans from multiple insurers to find the best fit. |

| Policy Management | Store and track insurance details in one central location. |

| Renewal Reminders | Get alerts before a policy expires so you never miss a deadline. |

| Claims Tracking | Submit and monitor claims directly through the dashboard. |

| Employee Data Sync | Automatically update workers’ comp and benefits details. |

| Digital Document Storage | Keep certificates, policies, and claims files in one place. |

| Custom Coverage Options | Adjust policies based on your business type or industry needs. |

Top 8 Small Business Insurance Platforms

| Platform | Best For | Key Features | Pricing |

|---|---|---|---|

| The Hartford | Established businesses seeking bundled coverage | BOP options, 24/7 claims, workers’ comp, online management | Custom quotes based on business size and coverage |

| NEXT Insurance | Freelancers and micro-businesses | Instant quotes, mobile access, tailored plans, COIs | Starts at $11/month |

| biBERK | Cost-conscious small business owners | Direct purchase, digital policy management, fast claims | Starts around $25/month |

| Thimble | Project-based and seasonal businesses | Hourly/daily policies, mobile COIs, flexible terms | Hourly from $5, monthly from $17 |

| Hiscox | Professional services and consultants | Custom policies, online setup, global liability | Starts at $30/month |

| CoverWallet | Businesses wanting multiple quote comparisons | Quote comparison, digital dashboard, COIs | General liability from $39/month |

| Simply Business | Retailers, tradespeople, and online sellers | Custom quotes, licensed advisors, policy bundles | Starts at $25/month |

| Embroker | Startups and firms needing industry-specific coverage | Tech-enabled quoting, cyber insurance, expert support | Starts around $40/month |

The Hartford

Overview

The Hartford is a well-established insurance provider with over 200 years of experience supporting small and midsize businesses. It offers a wide range of insurance products, including general liability, workers’ compensation, commercial property, and bundled Business Owner’s Policies (BOP).

Designed to support businesses across industries, The Hartford provides tools to quote, manage, and renew policies efficiently. The platform offers online account access, policy customization, and access to experienced advisors, helping business owners stay covered as their needs evolve.

Why Choose The Hartford?

- Trusted name with decades of experience in small business insurance

- Wide selection of policy types for various business sizes and industries

- Customizable BOP packages that simplify insurance management

- Online tools for claims tracking, policy updates, and certificate requests

- Reliable customer service and licensed specialists available for guidance

What are the Key Features of The Hartford

| Feature | Description |

|---|---|

| Business Owner’s Policy (BOP) | Combines general liability and property coverage into one cost-effective package. |

| Workers’ Compensation | Covers medical expenses and lost wages for work-related injuries. |

| Online Policy Management | Access policy documents, update coverage, and request certificates online. |

| Industry-Specific Solutions | Offers tailored policies for retailers, contractors, healthcare, and more. |

| 24/7 Claims Support | File and manage claims online with real-time updates and phone support. |

The Hartford Pricing Overview

The Hartford does not offer fixed pricing on its website, as costs vary based on your business type, size, location, and coverage needs. That said, here’s a general pricing structure:

- General Liability Insurance: Starts around $30/month for small businesses

- Workers’ Compensation: Typically based on payroll, risk class, and state requirements

- Business Owner’s Policy (BOP): More affordable than buying each policy individually

- Custom Quotes: Available via online form or direct call with a licensed advisor

For accurate pricing, it’s best to request a quote tailored to your business.

Integrations of The Hartford

The Hartford offers integrations with various platforms to enhance its services:

- HR & Payroll Systems: Workday

- Data Providers: Carpe Data

- Employee Benefits: Beam Benefits

Who are the Customers of The Hartford

Serves 1 million+ small businesses

Trusted by:

- AARP

- National Federation of Independent Business (NFIB)

- USAA members (partnered offering)

What are the Pros & Cons of The Hartford

| ✅ Pros | ❌ Cons |

|---|---|

| Longstanding brand trusted by thousands of small businesses | Pricing not fully transparent on the website |

| Wide range of coverages including bundled BOP options | Some policies may require phone interaction to finalize |

| Strong claims support with online tracking and 24/7 help | Industry-specific discounts not always available online |

| Online tools for managing and updating policies | No short-term or on-demand coverage options |

Final Thoughts

The Hartford is a strong option for businesses looking for comprehensive, reliable insurance management backed by experience. With policy bundles, tailored industry solutions, and responsive support, it’s well-suited for business owners who value both protection and convenience. While pricing requires a quote and some plans may involve speaking with an agent, the platform delivers dependable coverage and smooth policy management for growing teams.

NEXT Insurance

What is Next Insurance?

NEXT Insurance is a fully digital insurance provider designed specifically for small businesses. From quoting to certificate downloads, everything is handled online—quickly and without paperwork. NEXT focuses on delivering flexible, affordable policies across more than 1,300 business types, including contractors, retailers, fitness professionals, and consultants.

Its simple setup, clear pricing, and instant access to coverage make it an ideal solution for entrepreneurs who need fast, reliable insurance without the hassle.

Why Choose NEXT Insurance?

- Built for small businesses with 100% digital access

- Coverage tailored to specific industries and professions

- Instant quote, bind, and certificate generation

- Flexible monthly payments and transparent pricing

- Easy to update coverage as your business grows

Key Features of NEXT Insurance

| Feature | Description |

|---|---|

| Instant Quotes & Coverage | Get a quote, purchase coverage, and download your certificate in minutes. |

| Mobile Access | Manage your policy, update info, and share proof of insurance from your phone. |

| Industry-Specific Packages | Coverage tailored to fit the unique risks of your profession or business type. |

| General & Professional Liability | Protect your business from lawsuits, mistakes, and third-party damages. |

| Flexible Payment Plans | Pay monthly with no extra fees or lock-in commitments. |

NEXT Insurance Pricing Overview

NEXT is known for its transparent pricing. Coverage typically starts around $11/month, with actual costs based on:

- Business type and risk level

- State regulations

- Selected coverage types (e.g., liability, workers’ comp, property)

You can get a personalized quote in under 10 minutes directly on their website—no phone call required.

Integrations of NEXT Insurance

NEXT Insurance integrates with several platforms to provide seamless insurance solutions:

- Payroll & HR Platforms: Gusto, Netchex, Eddy

- Accounting Software: Intuit QuickBooks

- Point-of-Sale Systems: Toast

- Data Integration Tools: Rivery, Workato

- Insurance Distribution Platforms: Ivans Download

Customers of NEXT Insurance

Used by 500,000+ active small business owners

Industry segments include:

- Freelancers

- Contractors

- Home-based businesses

Pros & Cons of NEXT Insurance

| Feature | Description |

|---|---|

| Instant Quotes & Coverage | Get a quote, purchase coverage, and download your certificate in minutes. |

| Mobile Access | Manage your policy, update info, and share proof of insurance from your phone. |

| Industry-Specific Packages | Coverage tailored to fit the unique risks of your profession or business type. |

| General & Professional Liability | Protect your business from lawsuits, mistakes, and third-party damages. |

| Flexible Payment Plans | Pay monthly with no extra fees or lock-in commitments. |

Final Thoughts

NEXT Insurance is built for speed, simplicity, and small business needs. If you’re looking for fast coverage, flexible pricing, and minimal paperwork, it’s a top contender. Its mobile-first approach and tailored policies make it a favorite among entrepreneurs who want protection without the wait.

biBERK

Overview

biBERK is a direct-to-business insurance provider under the Berkshire Hathaway Insurance Group. It offers a streamlined, online platform for small businesses to obtain various insurance coverages, including general liability, workers’ compensation, professional liability, and more. By eliminating intermediaries, biBERK aims to provide cost-effective solutions, claiming savings of up to 20% compared to traditional providers.

Why Choose biBERK?

- Direct Purchase: Obtain insurance directly without brokers, simplifying the process.

- Cost Savings: Competitive pricing with potential savings due to the absence of middlemen.

- Comprehensive Coverage: Offers a range of policies suitable for various industries.

- Online Convenience: Manage policies, file claims, and access certificates through their digital platform.

- Financial Stability: Backed by Berkshire Hathaway, ensuring reliability and trustworthiness.

Key Features of biBERK

| Feature | Description |

|---|---|

| Direct-to-Business Model | Purchase insurance directly, reducing costs associated with brokers. |

| Online Policy Management | Access and manage policies, claims, and certificates through a user-friendly portal. |

| Customizable Coverage | Tailor policies to fit specific business needs across various industries. |

| Quick Claims Processing | Efficient claims handling to minimize business disruptions. |

| Financial Backing | Supported by Berkshire Hathaway, ensuring financial strength and reliability. |

biBERK Pricing Overview

biBERK offers competitive pricing, with potential savings due to its direct-to-business model. Here’s a general overview:

- General Liability Insurance: Starts at approximately $27.50 per month, with most customers paying less than $1,000 annually.

- Business Owners Policy (BOP): Begins around $500 annually, with most businesses paying under $2,000 .

- Professional Liability Insurance: Policies start around $300 per year, varying based on industry and coverage needs.

- Workers’ Compensation: Premiums are calculated based on payroll, with costs ranging from $0.75 to $2.74 per $100 in wages, depending on the state.

For precise pricing, it’s advisable to obtain a personalized quote through biBERK’s online platform.

Integrations of biBERK

biBERK collaborates with various partners to enhance its insurance services:

- CRM Systems: Salesforce

- Insurance Distribution Platforms: Bold Penguin, London Underwriters

Customers of biBERK

Trusted by over 200,000+ small businesses

Covers:

- Consulting firms

- Retail stores

- Construction businesses

Pros & Cons of biBERK

| ✅ Pros | ❌ Cons |

|---|---|

| Cost-effective due to direct purchase model | Limited in-person agent support |

| Comprehensive online policy management | Not all specialized coverages may be available |

| Backed by a financially strong parent company | May not offer bundled packages like some competitors |

| Quick and efficient claims processing | Customization options might be limited for complex businesses |

Final Thoughts

biBERK presents a streamlined solution for small businesses seeking straightforward, cost-effective insurance. Its direct-to-business model eliminates intermediaries, potentially reducing costs and simplifying the purchasing process. While it may lack some of the personalized services offered by traditional brokers, its online platform and backing by Berkshire Hathaway make it a reliable choice for many small enterprises.

Thimble

Overview of Thimble

Thimble is a modern insurance platform created for small business owners and freelancers who need flexibility. Unlike traditional insurance providers, Thimble allows you to purchase coverage by the hour, day, month, or year, making it perfect for project-based work or occasional gigs.

Whether you’re a photographer covering an event or a contractor on a short-term job, Thimble makes it easy to stay protected without overcommitting. The platform supports over 300 business types and provides instant access to certificates, making it a go-to option for professionals who need proof of coverage on the spot.

Why Choose Thimble?

- Coverage can be purchased only for the time you actually need

- Designed for busy professionals—quick to quote, bind, and manage

- Ideal for freelancers, seasonal workers, and on-demand service providers

- Instantly generates certificates of insurance (COIs)

- Available on both desktop and mobile for full policy access anytime

Key Features of Thimble

| Feature | Description |

|---|---|

| Flexible Coverage Periods | Buy insurance only for the time you need—hourly, daily, monthly, or annually. |

| Mobile-Friendly Platform | Manage policies, make changes, and access certificates from any device. |

| Instant Certificate Generation | Download or share your certificate of insurance within seconds of purchase. |

| Industry-Specific Coverage | Designed to suit 300+ professions, from pet sitters to event planners. |

| Liability Coverage Options | Offers general and professional liability insurance, with optional add-ons. |

Thimble Pricing Overview

Thimble’s pricing is designed to be as flexible as its coverage. You pay based on how long you need protection and the type of business you run. Here’s a general breakdown:

- Hourly plans: Starting at $5

- Daily plans: From $15, depending on the profession

- Monthly coverage: Starts at around $17/month

- Annual policies: Typically range from $200–$700/year

You can get a personalized quote on their website in less than 60 seconds, and no phone call is required.

Integrations of Thimble

Thimble provides flexible integration options for partners:

- API & Widgets: Thimble API, Thimble Widget

- Insurance Platforms: Tarmika

- Insurance Providers: Cerity

Customers of Thimble

- Popular with:

- Photographers

- Event planners

Pros & Cons of Thimble

| ✅ Pros | ❌ Cons |

|---|---|

| Offers short-term and pay-as-you-go insurance | Limited policy types compared to full-service insurers |

| Easy to use on mobile or desktop | May not suit businesses needing complex or multi-location coverage |

| COIs available instantly after purchase | No agent-based customer service for hands-on support |

| Tailored plans for niche and creative industries | No built-in payroll or accounting integrations |

Final Thoughts

Thimble is ideal for business owners and freelancers who value convenience and don’t need year-round insurance. If your work is occasional, seasonal, or project-based, it gives you the protection you need, only when you need it. With fast online quoting and real-time access to certificates, Thimble offers a practical, modern solution for on-the-go professionals.

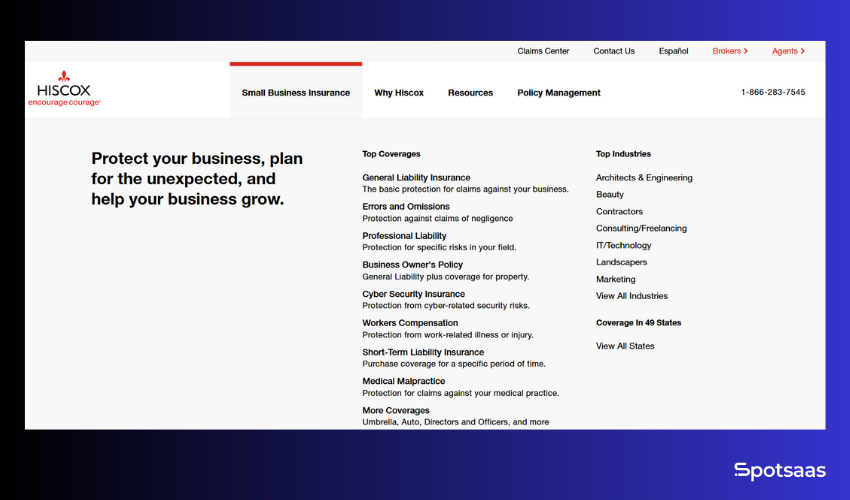

Hiscox

Overview of Hiscox

Hiscox is a well-known name in small business insurance, with a strong history of providing industry-specific coverage. It focuses on supporting independent professionals and small companies by offering customizable policies that fit the way modern businesses operate. From general liability to cyber protection, Hiscox covers a wide range of risks with policies designed to grow alongside your business.

Its digital platform lets you get a quote, manage policies, and download documents with ease, making it a practical option for owners who want control without the paperwork.

Why Choose Hiscox?

- Focuses on small businesses and independent professionals

- Offers policies that match the unique risks of your industry

- Easy-to-use platform for quoting and managing coverage online

- Discounts are available when you bundle multiple types of coverage

- International liability is available for businesses with global exposure

Key Features of Hiscox

| Feature | Description |

|---|---|

| General Liability | Protects against third-party claims involving physical damage or injury. |

| Professional Liability | Helps cover costs if you’re accused of professional errors or missed deliverables. |

| Business Owner’s Policy | Combines liability and property protection into one plan for simplicity. |

| Cyber Liability | Offers coverage for data breaches, digital threats, and related legal costs. |

| Workers’ Compensation | Supports employees with medical expenses and wages after workplace incidents. |

Hiscox Pricing Overview

Hiscox offers competitive pricing tailored to small business needs. While actual rates depend on your location, industry, and coverage limits, here’s a general idea:

- General Liability: Starts at approximately $30/month

- Professional Liability: From $22–$30/month for low-risk professions

- Business Owner’s Policy (BOP): Typically begins around $40–$50/month

You can get an instant quote through their website, and discounts are available for bundling multiple policies.

Integrations of Hiscox

Hiscox partners with various platforms to offer comprehensive insurance solutions:

- Insurance Distribution Platforms: Bold Penguin, CyberPolicy

Customers of Hiscox

Serves thousands of U.S. small businesses

Preferred by:

- IT consultants

- Real estate agents

- Marketing professionals

Pros & Cons of Hiscox

| ✅ Pros | ❌ Cons |

|---|---|

| Custom coverage based on profession or industry | Some plans not available in all states |

| Quote, buy, and manage policies online | Limited software integrations for back-office systems |

| Discounts when bundling multiple policies | Phone support not available 24/7 |

| Global protection included in some liability policies | May not offer real-time COI sharing through APIs |

Final Thoughts

Hiscox blends industry experience with modern convenience, making it a dependable choice for small business owners who want clear coverage and fast online access. While it doesn’t offer advanced integrations or round-the-clock support, its specialty coverage and digital simplicity make it a great fit for professionals and service providers looking for trusted protection without the hassle.

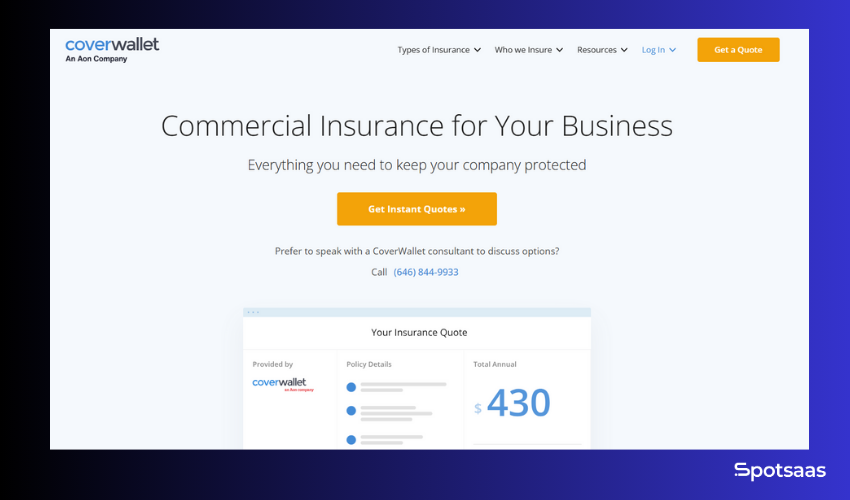

CoverWallet

Overview

CoverWallet is a digital insurance platform designed to simplify the process of obtaining and managing business insurance. Aggregating quotes from multiple carriers allows business owners to compare options and select coverage that aligns with their specific needs. The platform offers a user-friendly interface where policies can be purchased, managed, and renewed online, providing convenience and efficiency for small to mid-sized businesses.

Why Choose CoverWallet?

- Access quotes from various insurance providers to find competitive rates.

- Manage all your insurance policies in one centralized online dashboard.

- Receive coverage recommendations based on your business type and industry.

- Generate and share certificates of insurance quickly and easily.

- Consult with insurance advisors for personalized assistance when needed.

Key Features of CoverWallet

| Feature | Description |

|---|---|

| Quote Comparison | Compare insurance quotes from multiple carriers to find the best fit for your business. |

| Policy Management Dashboard | Manage all your insurance policies in one place with an intuitive online dashboard. |

| Instant Certificate Generation | Generate and share certificates of insurance instantly for client or vendor requirements. |

| Customized Coverage Recommendations | Receive tailored insurance recommendations based on your specific business needs. |

| Access to Insurance Advisors | Consult with experienced insurance advisors for personalized guidance and support. |

CoverWallet Pricing Overview

CoverWallet Pricing Overview

- General Liability Insurance: Starts at approximately $39 per month for most industries.

- Business Owner’s Policy (BOP): Begins at around $49 per month, combining general liability and property insurance.

- Workers’ Compensation Insurance: Averages about $45 per month, though rates can vary based on factors like location, number of employees, and industry. Investopedia

- Cyber Liability Insurance: Typically starts at $500 annually, depending on the size and nature of the business.

- Commercial Property Insurance: Premiums are influenced by the value of your assets and location; specific rates are provided upon obtaining a quote.

Note: These are general estimates. Actual premiums may vary based on specific business details such as industry, location, size, and coverage needs. It’s advisable to obtain a personalized quote for accurate pricing.

Integrations of CoverWallet

CoverWallet integrates with multiple platforms to simplify insurance processes:

- Payment Processing: Stripe Payments, Stripe Connect

- CRM Systems: Salesforce

- Insurance APIs: CoverWallet API

Customers of CoverWallet

CoverWallet serves a diverse range of small to mid-sized businesses across various industries, including:

- Consultants and Freelancers

- Retail and E-commerce

- Contractors and Tradespeople

- Hospitality Services

- Professional Services

Pros & Cons of CoverWallet

| ✅ Pros | ❌ Cons |

|---|---|

| Access to multiple insurance carriers for competitive quotes | Some policy types may require consultation with an advisor |

| User-friendly online dashboard for policy management | Limited integration with external business software |

| Instant generation of certificates of insurance | Not all industries may be covered through the platform |

| Personalized coverage recommendations based on business needs | Mobile app functionality may be limited or unavailable |

Final Thoughts

CoverWallet offers a streamlined solution for small business owners seeking to simplify their insurance needs. By providing access to multiple carriers, a user-friendly online dashboard, and personalized support, it enables businesses to obtain and manage coverage tailored to their specific requirements efficiently. While there may be limitations in terms of integrations and industry coverage, CoverWallet’s comprehensive approach makes it a valuable resource for many small to mid-sized enterprises.

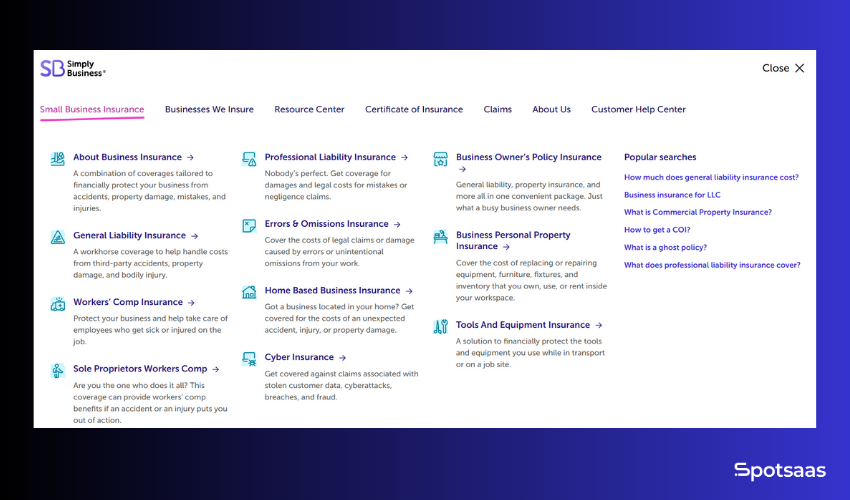

Simply Business

Overview

Simply Business is a digital insurance brokerage that simplifies the process of obtaining business insurance for small enterprises. Partnering with multiple top-rated insurers offers a platform where business owners can compare quotes and purchase policies that fit their specific needs. The user-friendly online interface allows for quick quote generation, policy management, and access to essential documents like Certificates of Insurance (COIs).

Why Choose Simply Business?

- Multiple Carrier Access: Compare quotes from various insurers to find competitive rates.

- Tailored Coverage: Receive insurance options customized to your industry and business size.

- Digital Convenience: Manage policies, download COIs, and handle renewals online 24/7.

- Expert Support: Licensed agents are available to assist with policy selection and questions.

- Transparent Pricing: Obtain clear, upfront pricing with no hidden fees.

Key Features of Simply Business

| Feature | Description |

|---|---|

| Quote Comparison | Access multiple insurance quotes from top carriers in one place. |

| Online Policy Management | Manage your insurance policies through an intuitive online dashboard. |

| Instant COI Generation | Generate and download Certificates of Insurance instantly. |

| Customized Coverage | Receive insurance options tailored to your specific business needs. |

| Expert Support | Consult with licensed insurance agents for personalized assistance. |

Simply Business Pricing Overview

Pricing for insurance policies through Simply Business varies based on factors such as business type, location, and coverage needs. While specific premiums depend on individual circumstances, here are general estimates:

- General Liability Insurance: Starting at approximately $25 per month.

- Professional Liability Insurance: Starting at around $45 per month.

- Business Owner’s Policy (BOP): Starting at about $40 per month.

- Workers’ Compensation Insurance: Starting at approximately $35 per month.

- Cyber Liability Insurance: Starting at around $40 per month.

Note: These are general estimates. Actual premiums may vary based on specific business details such as industry, location, size, and coverage needs. It’s advisable to obtain a personalized quote for accurate pricing.

Integrations of Simply Business

Simply Business collaborates with various partners to enhance its insurance offerings:

- Distribution Partners: First Connect

- API Solutions: Flexible API integrations

- Insurance Platforms: Tarmika

Customers of Simply Business

- Supports 1 million+ small businesses globally

- Popular among:

- Beauty professionals

- Tradespeople

- Online sellers

Pros & Cons of Simply Business

| ✅ Pros | ❌ Cons |

|---|---|

| Access to multiple insurance carriers for competitive quotes | Some policy types may require consultation with an advisor |

| User-friendly online dashboard for policy management | Limited integration with external business software |

| Instant generation of certificates of insurance | Not all industries may be covered through the platform |

| Personalized coverage recommendations based on business needs | Mobile app functionality may be limited or unavailable |

Final Thoughts

Simply Business offers a streamlined solution for small business owners seeking to simplify their insurance needs. By providing access to multiple carriers, a user-friendly online dashboard, and personalized support, it enables businesses to obtain and manage coverage tailored to their specific requirements efficiently. While there may be limitations in terms of integrations and industry coverage, Simply Business’s comprehensive approach makes it a valuable resource for many small to mid-sized enterprises.

Embroker

Overview

Embroker is a digital-first commercial insurance platform designed to simplify the insurance process for businesses. By leveraging technology and data analytics, Embroker offers tailored insurance solutions that cater to the unique needs of various industries. The platform provides a seamless experience, allowing businesses to obtain quotes, purchase policies, and manage coverage online.

Why Choose Embroker?

- Customized Coverage: Embroker offers industry-specific insurance packages, ensuring that businesses receive coverage tailored to their unique risks.

- Digital Convenience: The platform enables users to obtain quotes, purchase policies, and manage their insurance entirely online.

- Expert Support: Embroker combines technology with human expertise, providing access to experienced brokers for personalized assistance.

- Transparent Pricing: With Embroker, businesses can expect clear and upfront pricing without hidden fees.

- Integrated Risk Management: The platform offers tools and resources to help businesses proactively manage and mitigate risks.Embroker

Key Features of Embroker

| Feature | Description |

|---|---|

| Industry-Specific Packages | Tailored insurance solutions designed for various industries, including tech startups, law firms, and consultants. |

| Digital Policy Management | Manage all aspects of your insurance policies online, from obtaining quotes to filing claims. |

| Instant Certificate Generation | Generate and download Certificates of Insurance instantly for client or vendor requirements. |

| Risk Assessment Tools | Utilize built-in tools to assess and manage potential risks specific to your business operations. |

| Expert Broker Support | Access to experienced insurance brokers for personalized guidance and support. |

Embroker Pricing Overview

Embroker’s pricing varies based on factors such as business type, location, and coverage needs. While specific premiums depend on individual circumstances, here are general estimates:

- General Liability Insurance: Starting at approximately $25 per month.

- Professional Liability Insurance: Starting at around $45 per month.

- Business Owner’s Policy (BOP): Starting at about $40 per month.

- Workers’ Compensation Insurance: Starting at approximately $35 per month.

- Cyber Liability Insurance: Starting at around $40 per month.

Note: These are general estimates. Actual premiums may vary based on specific business details such as industry, location, size, and coverage needs. It’s advisable to obtain a personalized quote for accurate pricing.

Integrations of Embroker

Embroker offers integrations with a range of third-party applications to enhance its functionality and provide seamless experiences:

- Legal Practice Management: Clio

- Cybersecurity & Risk Management: Dashlane, Cowbell, SecurityScorecard

- Insurance Platforms: Millennial Shift (MShift)

Customers of Embroker

Embroker serves a diverse clientele across various industries, including:

- Tech Startups

- Law Firms

- Consultants

- Financial Services

- Real Estate Agents

Embroker’s client base includes over 9,500 businesses, ranging from startups to established enterprises, reflecting its versatility and commitment to serving various sectors.

Pros & Cons of Embroker

| ✅ Pros | ❌ Cons |

|---|---|

| Comprehensive, industry-specific insurance packages | Limited availability of in-person support options |

| User-friendly digital platform for policy management | Some advanced features may require a learning curve |

| Access to expert brokers for personalized assistance | Not all coverage options may be available in every state |

| Transparent pricing with no hidden fees | Mobile app functionality may be limited or unavailable |

Final Thoughts

Embroker stands out as a modern solution for businesses seeking streamlined, tailored insurance coverage. Its digital-first approach, combined with expert support, offers a convenient and efficient way to manage insurance needs. While there may be some limitations in terms of in-person support and feature availability, Embroker’s comprehensive offerings and user-friendly platform make it a valuable choice for many businesses.

Implementation Tips

Getting started with small business insurance software is usually straightforward. Here’s how to prepare and what to expect during onboarding:

What to Prepare

Before setup, it’s helpful to gather a few key documents and details to streamline the process:

- Existing insurance policies (PDFs or summaries)

- Basic business information (industry, size, years in operation)

- Employee data, if applicable (roles, number of staff, payroll estimates)

- Vehicle or asset records (for fleet, property, or equipment coverage)

Having these ready makes quote comparisons and policy setup faster.

Setup Timeline

Most platforms are designed to get you up and running quickly. Here’s a typical timeline:

- Initial setup and quote comparison: Within an hour

- Policy activation and dashboard access: 1–3 business days

- Certificate of Insurance (COI) downloads: Often instant after payment

For bundled or more complex plans, setup may take a little longer, but usually stays under a week.

Support You Can Expect

Even though many platforms are self-serve, support is readily available if you need it:

- Live chat: For quick questions during setup or renewals

- Phone support: Available through licensed agents or account reps

- Help center or training guides: Step-by-step walkthroughs, FAQs, and onboarding tips

- Email follow-ups: To remind you about renewals or incomplete setup steps

Whether you prefer to do things independently or want guidance from a real person, most providers offer a balanced mix of both.

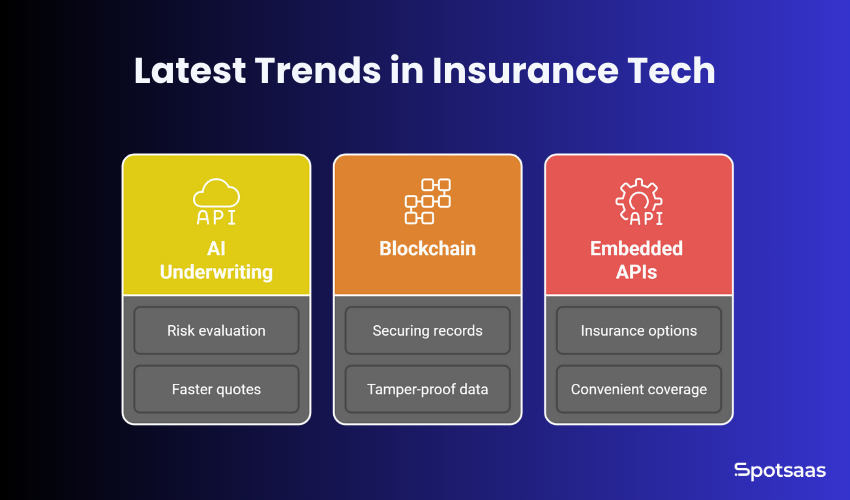

Latest Trends in Insurance Tech

The insurance industry is evolving rapidly, driven by new technology that’s reshaping how businesses buy and manage coverage. Here are a few trends making a real impact:

AI-Based Underwriting

Artificial intelligence is helping insurers evaluate risk faster and more accurately. Instead of relying solely on manual processes, AI uses data from applications, industry trends, and historical claims to generate quotes in seconds. This not only speeds up decision-making but also improves pricing accuracy for small businesses.

Blockchain for Documentation

Blockchain is gaining ground in insurance for its ability to secure policy records and claims data. With a decentralized and tamper-proof structure, it ensures that documents like Certificates of Insurance (COIs) and claims histories remain consistent, traceable, and verifiable—especially useful during audits or disputes.

Embedded Insurance APIs

Insurance is being woven directly into digital experiences through APIs. For example, SaaS platforms, marketplaces, and e-commerce sites can now offer insurance options at checkout. This trend—known as embedded insurance—helps businesses get coverage at the point of need, without switching platforms or filling out repetitive forms.

Conclusion

Choosing the right small business insurance software is about more than just coverage—it’s about finding a platform that simplifies your workflow, protects your operations, and grows with your business. From comparing quotes and managing policies to accessing instant certificates and staying compliant, the right tool can save you time and reduce risk.

Whether you’re a solo contractor, a growing startup, or managing a team across multiple locations, today’s insurance platforms offer flexible, tech-driven solutions built for modern business needs.

Take the time to assess your risks, review feature sets, and explore trial options or demos. With the right software in place, you’ll gain peace of mind and stay focused on what matters most—running your business.

Frequently Asked Questions

What is small business insurance software?

It’s a digital platform that helps you compare, purchase, and manage insurance policies for your business.

Who should use this type of software?

Small business owners, freelancers, brokers, and HR managers need a simple way to handle insurance tasks.

Can I manage multiple policies in one place?

Yes, most platforms offer a central dashboard to track all your active policies and renewal dates.

Does the software generate certificates of insurance (COIs)?

Yes, many tools let you create and download COIs instantly.

How long does it take to get started?

Setup is usually quick—most users can get a quote and activate coverage in under a day.